Most

likely! However, you can reduce the tax for sure.

This

article will focus on Capital Gains on sale of property and how you can save

some tax thereon.

Which Tax And Why?

Income Tax Act mentions that any gains arising from the sale of any assets attracts tax. Either it is Short Term Capital Gain or Long term Capital Gain.

|

| Image source: Chartered Club |

Income Tax Act definition is as below:

1. Short Term Capital Gain (STCG) :

Asset is held for less than 36 months

2. Long

Term Capital Gain (LTCG) : Asset is held

for more than 36 months

Any such gain attracts STCG Tax or

LTCG Tax. STCG Tax rate is as per the

individual’s tax slab rate and LTCG Tax rate is 20% on LTCG with Indexation.

|

| Image source:bwcaa.org |

How

Is It Calculated?

1. Short Term Capital Gain (STCG) is simple

to calculate, i.e. if the property is sold within 36 months all you have to do

is use this format to arrive at your Net STCG.

As mentioned earlier the STCG shall

be taxed as per the individual’s tax slab rate.

2. Long Term Capital Gain (LTCG) is little

more elaborate than STCG, i.e. if the property is sold after 36 months of

acquiring the same.

TAX

@ 20% shall be payable on the long term capital gain computed above and advance

tax shall also be liable to be paid on such capital.

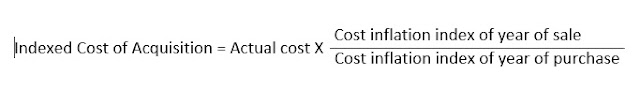

Indexed cost of acquisition is

calculated as below:

Check

here to get the Index for the year you purchased the house and the year you sold or

are planning to sell house.

How

To Reduce The Tax Liability?

Can I save tax? Yes. Most

important part for all of us. After all, the gruesome Income Tax Department does

have some consideration towards us.

Exemptions are only in case of LTCG

and no such exemptions are provided for STCG.

These

exemptions fall under section 54 and section 54EC of Income Tax Act, 1961.

1. Under

section 54 the entire LTCG will be exempt from tax if the seller uses the

entire LTCG amount to build a new house within 3years of sale of the house

property or purchase a new house within 2 years of the sale of property.

However, if you cannot decide right away, the LTCG amount can be parked in a

Special Account called the Long Term Capital Gain Account. The funds should be

used for either of the purposes mentioned above, within the span of 3 years or

LTCG will be taxable.

1. Under

section 54 the entire LTCG will be exempt from tax if the seller uses the

entire LTCG amount to build a new house within 3years of sale of the house

property or purchase a new house within 2 years of the sale of property.

However, if you cannot decide right away, the LTCG amount can be parked in a

Special Account called the Long Term Capital Gain Account. The funds should be

used for either of the purposes mentioned above, within the span of 3 years or

LTCG will be taxable.

2. Under section 54EC the seller can

alternatively invest in the bonds u/s 54EC up to a maximum amount of Rs. 50

lacs and avail exemption under LTCG. The LTCG arising from sale of property can

be invested in following two bonds :

·

National

Highway Authority of India (NHAI) Bonds

·

Rural

Electrification Corporation (REC) Bonds

Both the bonds have a lock-in period of 3 years and pay out interest around 6% annually.

Note: Interest earned in NHAI bonds

and REC bonds as well as LCTG account are taxable.

Illustration With An Example:

If Mr. A had purchased flat in

2004-05 at Rs. 60 lacs and has sold the same house in year 2014-15 at Rs. 1.30

crores. The computation of Capital Gain is as below:

- Since the asset was held for more than 36 months it is LTCG.

- Cost Inflation index(CII) for year 2004-05 is 480 and CII for year 2014-15 is 1024

- Therefore Indexed cost of acquisition will be Rs. 60,00,000 x ( 1024/480) = Rs. 1,28,00,000/-.

- Resulting LTCG will be 2,00,000/- (1.30 cr - 1.28 cr)

- LTCG tax is 20%, hence LTCG Tax on Rs. 2,00,000 @ 20% = Rs. 40,000/-.

- To save a tax of Rs. 40,000/- Mr. A can either use LTCG of Rs. 2,00,000/- to build a new house within 3 years or purchase a house within 2 years or alternatively invest the LTCG of Rs. 2,00,000/- in either of the bonds mentioned u/s 54EC; making his tax liability NIL under LTCG.

|

| image source: www.iocomprocasa.com |

Conclusion:

- In case of STCG the applicable tax rate is according to the individual’s slab rate.

- LTCG Tax is @ 20% with indexation on LTCG only and not on the whole amount.

- Tax can be saved u/s 54 and u/s 54EC.

- Short Term Capital Loss can be adjusted against STCG or LTCG in the same financial year.

- Long Term Capital Loss can be adjusted ONLY against LTCG in same financial year or LTCG in subsequent 8 financial years.

To know more about Capital Gains and

Bonds u/s 54EC or any queries regarding your assets or ways to save and grow

your money, kindly reach me at mymoneymanager.

No comments:

Post a Comment